Tuition Taxation

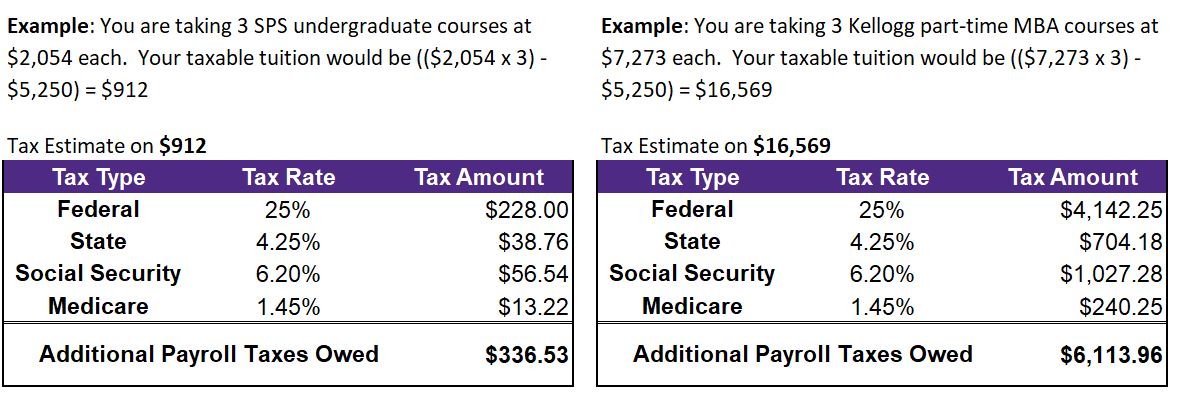

All Employee Tuition Benefits above $5,250 received per calendar year must be taxed as non-cash compensation and added to an employee's taxable wages. Taxes are assessed in the year in which the funds are received. Additional information can be found on the IRS website.

This means your net pay (take-home) will be reduced due to additional payroll being taxes withheld.

Employee reduced tuition benefits

Employee Reduced Tuition benefits provided above $5,250 received per calendar year must be taxed as non-cash compensation and added to an employee's taxable wages. This means your net pay (take-home) will be reduced due to additional payroll being taxes withheld. Employee reduced tuition benefits are taxed evenly across all pay periods in a given quarter – three paychecks for monthly employees; five for bi-weekly employees – to distribute the taxation over time and decrease the impact on a single paycheck.

Estimate your additional taxes

Below is a calculators that will help you estimate the reduction in your net pay (take-home) due to additional taxes incurred when using the employee reduced tuition benefits.

- Use this Calculator to determine annual taxes before you register for classes.

- Use this Calculator to determine taxes for the current term after you have been billed by Student Finance.

Please note that the tuition impute isn’t a stand alone taxable event. It is taxed in addition to wages. All taxable earnings are combined and taxed at the appropriate annualized rate for each employee.

In cases where imputed income cannot be spread over multiple checks and the need to add the full impute to one check it may bump you into a higher tax for that pay check.

Employee portable and certificate tuition benefits

Because these benefits are reimbursed in a single lump sum, the full tax due is withheld from the paycheck on which the reimbursement is paid.

Dependent reduced and portable tuition benefits

Dependent tuition benefits are non-taxable benefits. No taxes will be withheld for these benefits.

Taxes upon termination

In the event your employment ends before all

If you leave employment before all the imputed taxes are withheld, they will be added to your W2