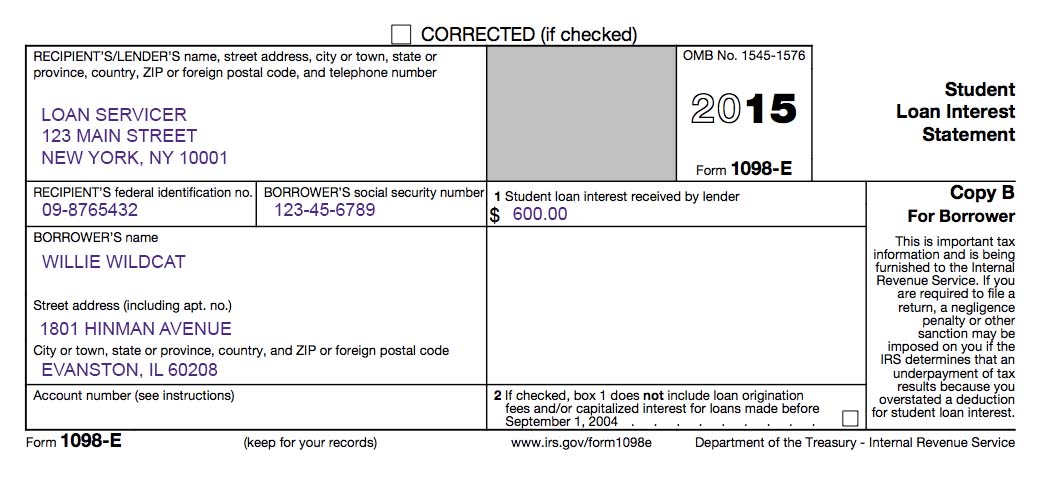

1098-E Student Loan Interest Statement

Your loan servicer issues a 1098-E statement which reports the amount of loan interest paid on a student loan during the year for borrowers in repayment. Some borrowers may be eligible to use this amount that appears in Box 1- or a portion of it- as a tax deduction on their taxes.

Loan servicers are required to report 1098-E information to the IRS and to borrowers when the amount of interest is $600 or more for the year. If the amount of interest paid is less than $600, a borrower can access this information directly from the loan servicer.

Note: This is not the total amount in payments made for the year. This figure does not include any payments made toward the principal of the loan.

Borrowers should remember that if they have more than one loan servicer to whom they are making payments, they should check the 1098-E amounts from each servicer if they are considering using the deduction for the tax year.

For more information

Visit the IRS website. You should refer to IRS tax code or consult your tax advisor for specific information on how this deduction may be specifically applied to your taxes. There is a maximum amount of interest paid can be used toward the deduction. There are income caps tied to eligibility as well.

The U.S. Department of Education's website also provides some additional information to help you understand the 1098-E process.

For information on the 1098-T Tuition Statement and the 1098-E Student Loan Interest Statement, please refer to the Student Financial Services website.

See also: how to use the National Student Loan Data System (NSLDS).