Get Your Piece of the Pie

Terry Stephan MS ’78 is a freelance writer in Chicago.

Tell us what you think. E-mail comments or questions to the editors at letters@northwestern.edu.

Find Us on Social Media

No matter how you slice it, Social Security is an insurance plan for your retirement years. Business writer Philip Moeller and two co-authors have written a best-selling book to help you maximize your benefits.

For the 10,000 Baby Boomers who turn 65 each day, and millions of other Americans planning for retirement benefits, the Social Security Administration can often seem like a behemoth of a federal agency, laden with rules and regulations so cumbersome and confusing that they will prevent them from fully enjoying their golden years.

It’s not an entirely unfounded fear.

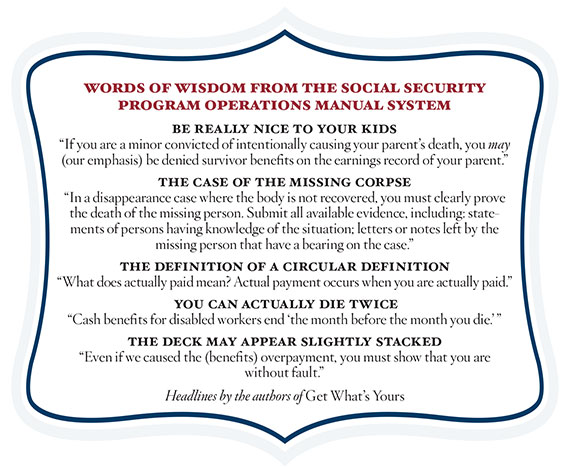

Social Security’s Program Operations Manual System contains 2,728 core rules and thousands and thousands of additional provisions that supposedly clarify the rules. Navigating through this maze of do’s and don’ts can baffle the most knowledgeable retiree.

Phil Moeller

Financial journalist Philip Moeller ’70 MS has spent years writing articles about people who collectively leave tens of billions of dollars in Social Security benefits on the table by failing to claim everything to which they are entitled. Yet he was surprised to learn how often Social Security’s own representatives give people the wrong advice because even they don’t understand the system.

Boston University economist Laurence Kotlikoff had noticed that some beneficiaries get more than others, simply because they have figured out the system’s rules — which doesn’t seem fair.

Eventually Kotlikoff, Moeller and PBS NewsHour correspondent Paul Solman decided to write a how-to book together about ways to maximize one’s benefits by using available, but often unknown or misunderstood, options within the system.

Last February, Get What’s Yours — The Secrets to Maxing Out Your Social Security (Simon & Schuster, 2015) went on sale and immediately landed on several best-seller lists, including Amazon and the New York Times.

The fact that a book that basically explores the sometimes incomprehensible guidelines of a government agency could achieve such instant popularity inspired a headline writer at Bloomberg Business to title its book review “Social Security on the Best-Seller List? The New Over-50 Shades of Grey.”

Americans’ Most Important Retirement Asset

The three financial heavyweights bring a wealth of experience to the book. Kotlikoff is president of Economic Security Planning, a firm that produces financial planning software. Moeller writes about Social Security, Medicare and other retirement issues for Money and, previously, U.S. News & World Report. He is also a research fellow at the Center on Aging & Work at Boston College. Solman teaches at Yale University and has been the business and economics correspondent for PBS NewsHour since 1985. All three write for PBS NewsHour’s Making Sen$e website.

The authors wrote the book because, they say, “Social Security is, far and away, Americans’ most important retirement asset.” In fact, they add, “For most people, Social Security is their only retirement option.” And it’s “an economic lifeline for most older Americans. Today, people who are 65 and older have the lowest poverty rate of any age group in the nation. Before Social Security was adopted, older citizens had the nation’s highest poverty rate. It’s not the tooth fairy that caused this hugely important shift. It’s been Social Security and, for the past 50 years, Medicare.”

They caution that “Social Security is not an investment program but an insurance policy against living too long.” They want to help everyone who qualifies better understand how to receive the benefits to which they are entitled. But that is easier said than done.

“Figuring out what to apply for and when to do it is not simple,” they write. “Indeed, Social Security is the most complicated ‘simple’ program you’re ever likely to encounter.”

“To me, Social Security in 2015 is a logical, if undesirable, consequence of an 80-year-old federal program that has been expanded, amended and reformed over the years to the point that it is too complicated for mere mortals to understand, let alone use properly,” says Moeller.

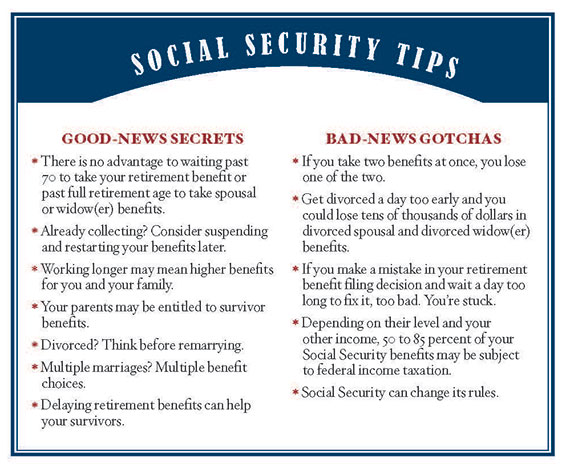

Currently, the full retirement age is 66 and maximum is 70. Though the financial upsides of waiting to start collecting benefits at age 66 or 70 are substantial, most people are not aware of the merits of delaying. In 2012, 63 percent of men and 69 percent of women took benefits before full retirement age. Only 1 percent of men and 2 percent of women waited until maximum retirement age.

The authors offer information on a variety of benefits, but the focus is on retirement benefits and the ways to maximize them. They distill the strategy down to three general rules: be patient; take all the benefits you can; and get the timing right.

The Three Most Important Rules for Social Security

“People are living longer, so retirements are going to last a long time — 30 to 40 years for many,” Moeller says. “So, the first rule is to be patient. Don’t rush to take benefits at age 62 just because you can. Consider waiting, perhaps as late as age 70, when they will be 76 percent higher.

“Second, get all the benefits to which you are entitled, meaning that you need to not only consider your own retirement benefits but also spousal benefits, ex-spousal benefits, survivor benefits for current and former spouses, disability benefits, and even child and parent benefits.

“Third, get the timing right. Claim too early and you can be hit with enormous penalties that last a lifetime. Wait too long and you can leave a lot of money on the table.”

Rule 1 is the most significant and the easiest to understand, and it underscores the adage that good things come to those who wait.

For example, “If you were due a monthly $1,000 retirement benefit at age 66, it would be reduced by

25 percent to $750 if you claimed benefits at age 62. It would rise 32 percent (four times the 8 percent annual increase) to $1,320 if you deferred benefits until age 70. The difference between $750 and $1,320? A whopping 76 percent.”

Rule 2 is all about benefits. The authors point out that many people are entitled to auxiliary benefits (paid to the spouse, former spouse, survivor, child or parent of a Social Security–covered worker and equal to a specified percentage of the worker’s basic monthly benefit amount), though most aren’t aware of the concept. In fact, a tennis game conversation between Kotlikoff and Solman that led to the discussion of writing a book about Social Security centered on the virtues of applying for auxiliary benefits.

At the time of the conversation, Jan Solman was almost 66 and Paul 65. Kotlikoff’s suggestion to maximize their benefits was as follows: Have Jan apply for her Social Security retirement when she turned 66 but then “suspend” it, so that she would make herself eligible for the money but wouldn’t take it at that time. Paul would apply for only a spousal benefit, and when each turned 70, they would each take their own retirement benefits, at which point they would start at their highest possible value.

According to the book, “If Jan’s Social Security full retirement benefit were, say, $24,000, [Paul would] be eligible to get half that as a spousal benefit: about $12,000. And if you get $12,000 a year from age 66 to 70, that’s $48,000.”

Rule 3 concerns timing, especially when it applies to people who are divorcing. The authors cite the discouraging statistic that between 40 and 50 percent of all marriages in the United States end in divorce. And the median length of these marriages is eight years.

“That means more than half of the divorced are making a big financial mistake,” the authors write in the book.

According to Social Security rules, you need to remain married at least 10 years to be able to collect spousal and survivor benefits as an ex-spouse. The benefits can be significant.

In fact, the benefits of “getting it right” on when and how to apply can have an impact for most Americans. “Given the virtual disappearance of company pensions, except for those grandfathered under old plans, and the failure of most Americans to either contribute or contribute fully to 401(k), IRA and other retirement accounts, Social Security is, well, pretty much it for pretty much all of us,” say the authors.

It is especially important that women make their decisions in ways that maximize their benefits. There is a chapter in the book that spells out why: “Social Security Is a Major Women’s Issue.”

“Women live longer than men and, especially at older ages, tend to rely on Social Security for most if not all of their income,” says Moeller.

“However, women also earn less than men and thus have lower Social Security retirement benefits than men. If married, women qualify for Social Security survivor benefits that could be much higher than their own retirement benefits. However, survivor benefits usually are based on the actual retirement benefit their late husband received. Because most people file early and don’t wait until age 70 to maximize their benefits, their widows are stuck with meager survivor benefits for what often are very, very long remaining life spans.”

Advice for Children of Soon-to-Be Retirees

“Throughout the book we make the point that this information should also be useful for the adult children of people nearing retirement,” says Moeller. “They should really be paying attention to these issues. They can assist their parents in working through the information and in making decisions on benefits. For some people in their 60s, their level of financial literacy begins to decline, so they need some help with this.”

Moeller is more optimistic about the future of Social Security than co-author Kotlikoff and many who study the issues involved.

“Social Security’s funding challenges are well known, and there are many ways to close its longer-run shortfalls that will neither strip seniors of needed and deserved benefits nor saddle future generations with unsustainable tax increases,” he says. He believes that it’s possible to make the program self-supporting through a broad mix of benefits, timing and payroll tax changes.

“ISIS and terrorism? Climate change? Economic inequality? These are among the serious problems we face,” Moeller says. “By comparison, Social Security reform is a walk in the park. We just need to get on with it, and I believe that the accumulated pressure of 10,000 Baby Boomers a day turning 65 ultimately will provide the leverage to get it done.”

Moeller is currently working on a companion book to Get What’s Yours that focuses on getting the most out of Medicare. He is going solo on the writing but reflected on the process of writing a book with two other authors.

“Opportunities and challenges rise geometrically with multiple authors,” he says. “On the upside, we have something like 140 years of experience amongst the three of us and could call on a depth of expertise that few individual authors have. We could and did divvy up the writing work. And we also have diverse viewpoints and voices that can enrich the book. On the downside, we have diverse viewpoints and voices!

“We had no idea the book would be so successful,” adds Moeller. “Writing a book is hard. You convince yourself that you’re doing God’s work, but we didn’t know that it would do this well. We wanted to write something that would be of real value to real people.”

He’s always been interested in writing. After majoring in English at Princeton University, he took a job at a Chicago firm that was training English majors to be accountants but quickly learned it wasn’t for him. His next move was graduate school at the Medill School of Journalism, Media, Integrated Marketing Communications.

Moeller credits a business journalism class taught by professor and mentor Elizabeth Yamashita ’59 MS, ’69 PhD for inspiring his interest in this field. His only job offer after graduation came from the Charlotte Observer, where he became a reporter and columnist on the textile industry. A few years later he moved back to Chicago to work on the business desk at the Chicago Sun-Times. And he taught business journalism at Medill for two years.

Moeller, who now lives in Richmond, Va., left newspapers in 1993. “I became interested in issues related to retirement, insurance and longevity,” he says. “I thought these issues were going to be front and center because of the number of Baby Boomers facing retirement. That morphed into writing about Social Security and Medicare for U.S. News & World Report and PBS.

“The longer I do journalism, the more important I think journalism is. I have no interest in stopping working — ever.”

Facebook

Facebook Twitter

Twitter Email

Email